Do you qualify for Medicare?

In most cases, you (or your spouse) will qualify as long as you were employed for at least 10 years (40 quarters), are a permanent resident of the United States, and are 65 years old or older. If you are under that age, you might still be eligible for Medicare if you have End-Stage Renal disease (kidney failure that necessitates dialysis or a transplant), or are disabled.

You can receive Part A if you are 65 or older and won’t have to pay premiums if:

- The Railroad Retirement Board or Social Security is currently providing you with retirement benefits.

- You are eligible for Railroad benefits or Social Security, but have yet to apply for them.

- You or your spouse were employed by the government.

If you are younger than 65 years old, you can obtain Part A and won’t have to pay premiums if:

- You have received Railroad Retirement Board or Social Security disability benefits for 2 years.

- You are a patient who received a kidney transplant or kidney dialysis treatment.

If you meet at least one of those criteria, you won’t have to pay a premium for Part A. If you want Part B, you will have to pay for it. The fee is subtracted from your Railroad Retirement, Social Security, or Civil Service Retirement check. Medicare sends you an invoice for your Part B premium every 90 days if you don’t receive any of the above payments.

If you have questions regarding your qualifications for Part A or Part B, simply contact Social Security at 1-800-772-1213. TTY users should call 1-800-325-0778. Ask for more information about purchasing Part A and Part B if you aren’t eligible for premium-free Part A.

Medicare is Comprised Of:

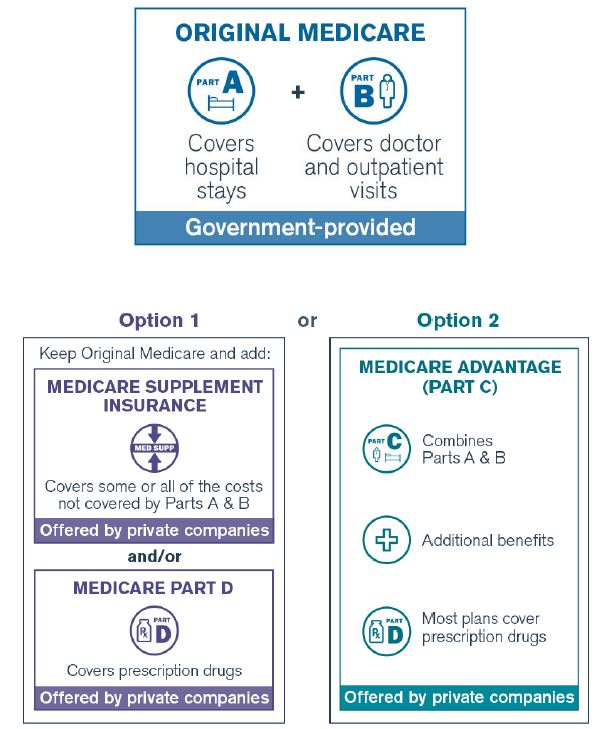

Part A Hospital Insurance – If you or your spouse have already paid for coverage through payroll taxes while employed, you likely won’t have to pay a premium for Part A. Medicare Part A assists in covering inpatient hospital care, and includes skilled nursing facilities and critical access hospitals (not long-term care or custodial). It also helps cover fees for hospice care and several other forms of home health care.

Part B Medical Insurance – Most individuals pay a monthly premium for Part B, which aids in covering outpatient care and doctors’ services. It also covers other medical services that Part A doesn’t, including occupational and physical therapy. Part B helps in covering these services and supplies when they are medically required.

Part C – Advantage Plans are provided by private organizations contracted with Medicare to offer Part A and Part B benefits. The plans offered are Preferred Provider Organizations, Special Needs Plans, Health Maintenance Organizations, Medical Savings Account Plans, and Private Fee-for-Service Plans. If you sign up for a Medicare Advantage plan, services are covered by that plan instead of Original Medicare. Most Advantage Plans offer coverage for prescription medications.

Part D Medicare Drug Program – Part D is a program that assists people with Medicare in paying for prescription drugs. You can get a drug plan that is included with a Medicare Advantage Plan or as a stand alone Prescription Drug Plan. Such plans are provided by insurance companies and various private Medicare-approved organizations.

You will automatically be signed up for Part A and B if you are receiving Social Security payments. Part B has a monthly premium that is subtracted from your Social Security check at the beginning of the month after you turn 65. Your Medicare card will be sent to you 90 days prior to your birthday month. It will have vital information that is necessary upon signing up for a Part D plan, Medicare supplement, or a Medicare Advantage plan. Your Medicare number is comprised of a series of random numbers and letters. Your Social Security number is no longer used in your Medicare number.

If you are not receiving Social Security payments, you will have to call Social Security and let them know you want Part B. They can be reached at 1-800-772-1213. Alternatively, you can register online at Medicare.gov.

The graphic below illustrates the basic choices you have for Medicare insurance. For more information on each option, visit the Medicare Advantage, Medicare Supplements and Prescription Drug plan pages on this website.

Important Dates to be Mindful Of:

September and October – Examine any notices from your plan regarding changes for the coming year.

October 15th – Annual enrollment period starts. You can change your coverage for the following year starting on this date.

December 7th – Annual enrollment period ends. Generally, December 7th will be the final day you can change your coverage for the next year. Your enrollment application must be received by December 7th.

January 1st – Coverage starts if you have changed plans. If you remain with your existing plan, any changes to benefits, coverage, or fees will start on January 1st.

Between January 1st and March 31st, if you are part of an Advantage Plan (such as a PPO or HMO), you are given one more opportunity to change to another Advantage plan or go back to Original Medicare and enroll in a Medicare Supplement if you choose. During this period, if you change your plan to Original Medicare, you can also add drug coverage by joining a Prescription Drug Plan. Once your enrollment application is processed, coverage will start on the first day of the following month.

Helping you through the Medicare maze…

Brent Eigsti

602-926-0035